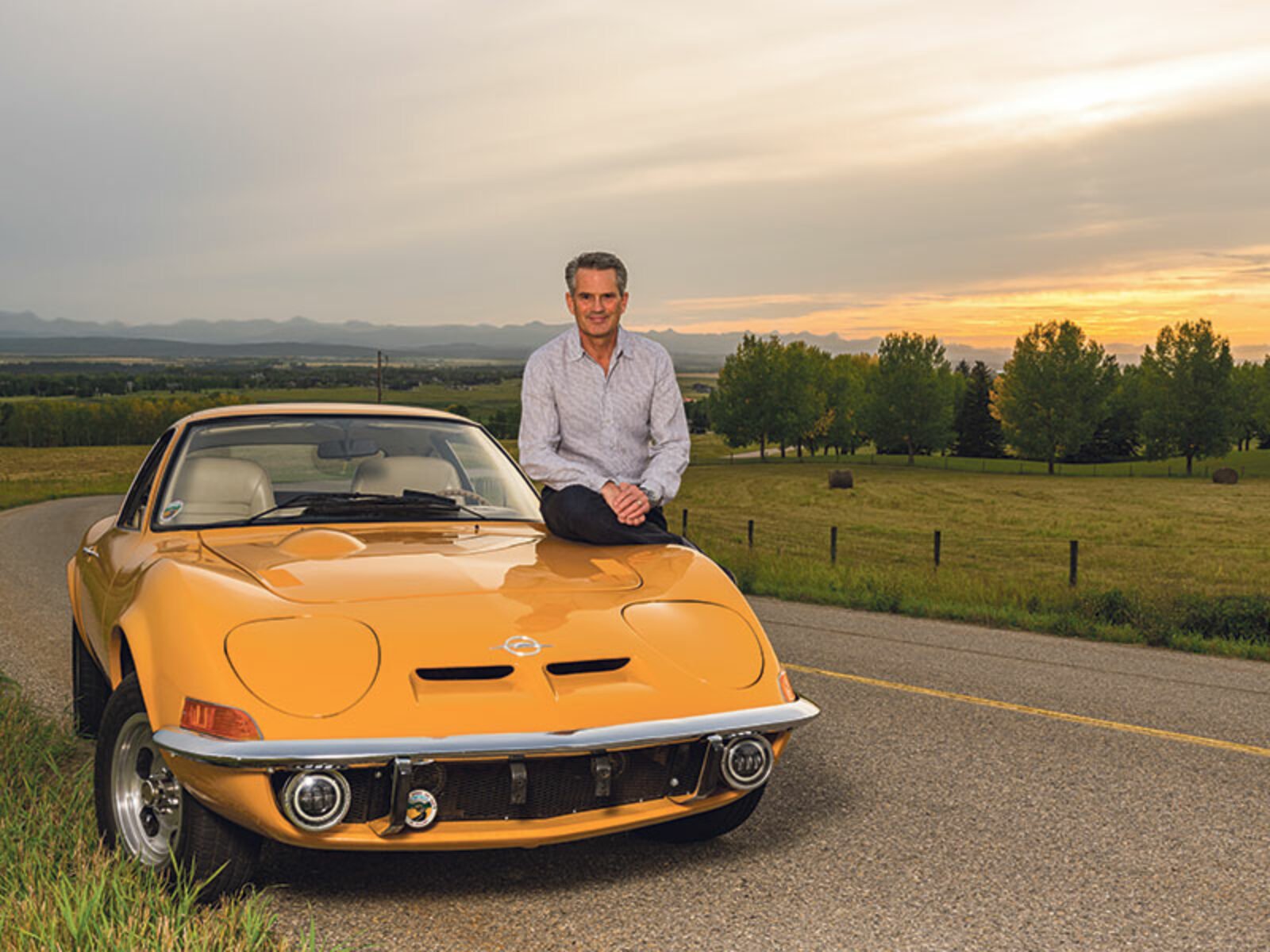

Sterling Rempel

CFP®, CIM®, CLU, TEP, MFA-P, FP Canada™ Fellow

Wealth Manager and Founder

Future Values Estate & Financial Planning

Investment Consulting, Wealth Protection, Wealth Enhancement, Wealth Transfer & Charitable Giving

“My greatest satisfaction is helping my clients unleash their inner philanthropist. I love when people realize an expanded vision of what is possible for them, their money and their important causes.”

Sterling Rempel has served his clients as an independent wealth manager since 1999.

Sterling holds the distinction “FP Canada™ Fellow” an honour awarded to only 70 of over 17,000 CFP® professionals in Canada.

He is uniquely equipped to assist clients with a strategic, holistic approach to values-based wealth management:

- An award-winning financial planner

- An experienced Investment Advisor

- Certified as a Responsible Investment Advisor

- A specialist in tax-advantaged use of life insurance, disability and critical illness insurance

- A Trust & Estate Practitioner

Sterling has a long history with the charitable sector. He and his family have created two donor-advised legacy foundations, benefitting healthcare, education, religious, global relief and microcredit organizations.

As an entrepreneur & employer, Sterling understands the unique stresses faced by small business owners, their employees and self-employed professionals.

A loving husband, a parent to four children, and a grandfather to two little girls, Sterling & his wife unwind in their two vintage sports cars, and the ongoing restoration of a 1974 Airstream trailer.