Donating to charity is a pretty straightforward process, right? Well, you may be in for a pleasant surprise. There’s a whole world of financial strategies that help you make a bigger, more effective donation while saving on taxes. Most Canadians are not aware of these strategies, so to shed some light we spoke with Candice Jay, a Wealth Advisor at CCI Private Capital.

Listen to the conversation as Candice shares some invaluable financial advice and tips she uses with clients to maximize their donations.

The following is a transcript of the conversation:

Laurie Fox, Will Power Campaign Director: Candice, you help clients make decisions about their money. But something that’s unique about you is that you bring charitable giving into financial planning discussions. That’s not something a lot of advisors do. Can you tell us why it’s important to help clients plan their charitable donations?

Candice Jay, Wealth Advisor, CCI Private Capital: I would say that this started off as a little bug in my ear over 10 years ago, and it’s really grown into something quite beautiful. It’s a key part of my practice – helping clients think about their passions and missions and different ways they can leave a legacy in the world. I’d really hope there’s more advisors out there doing this, but in reality there aren’t a lot of advisors that are incorporating this into their practices.

Laurie: What is the biggest mistake you see people make with their donations?

Candice: The first thing that’s very noticeable is that they could be giving more efficiently. People just want to give cash, what’s easy. But instead of donating a thousand dollars in cash, for example, you could donate any appreciated security that you have in a stock portfolio and get the double benefit of not needing to pay capital gains on that appreciated stock and still get the full donation tax credit.

You’d have to pay [taxes] anyways, but you would redirect the amount that you would have to pay in taxes towards a charitable donation instead

Laurie: Can you give an example of a client you helped to donate more efficiently, what financial tools they used, and what the benefit was?

Candice: I have a client who was always passionate about nature, her alma mater, and her husband’s engineering work and wanting to give back there. Unfortunately her husband passed away and they didn’t finish their overall giving plan together, even though they were thinking about it before.

But she really dived deep [into a giving plan] and loved the whole experience of actually going through the thought process, talking to the different charities that they wanted to leave a legacy to, etc. Especially because she was helping to leave her husband’s legacy as well.

So when we first looked at everything we identified what capacity can she give in? Does she have enough for herself? Is she going to be okay to maintain her lifestyle as she ages and maybe needs to spend a little more?

Then after that you can come up with the excess capital amount. And with that excess capital she could go on vacations, give gifts to family members…and a big part of that is her charitable giving. So now that we had an amount to work with, she could now allocate to the different missions and visions that she and her husband had.

So this is where then you look at, okay, do you have any insurance policies that are no longer needed and you can donate them? Do you have appreciated securities? A lot of people have a stock like this that will have a $10,000 book value but is $300,000 worth in market value, and that is a HUGE capital gain. It’s so enormous that you don’t really want to touch it, so you feel frozen, because you don’t want to be incurring the capital gains and you don’t want to pay the taxes on them. So these are perfect securities to be donating to charity.

The last thing I will mention is my client’s RRIF [Registered Retirement Income Accounts] accounts. Before, the beneficiary of her RRIF account was a niece and nephew. She said “you know what, they actually don’t really need it. I can give them money some other way. So I will instead name some charities as beneficiaries of my RRIF”.

Laurie: Do you often have people who ask “What about my children. I want to leave my estate to them”? What do you tell them about contributing to charity from their estates?

Candice: I do get some responses, people who say “My charity is actually my children and grandchildren”. When they say that, I ask “do you know that there are actually ways that you can help redirect your tax burden to charity?” So you’d have to pay anyways, but you would redirect the amount that you would have to pay in taxes towards a charitable donation instead.

That usually opens up the conversation. The big message is that your children and grandchildren don’t get less. We’re just trying to be more strategic in order for your children and grandchildren to receive however much you want to give them, but also for charities to benefit.

Laurie: For people who are interested in planning out their donations – contributing through their Wills, RRSPs or RRIFs as you mentioned – what is the top piece of advice that you would give them to start the journey.

Candice: So I would say start small to begin with. As you get comfortable, as you start seeing how easy it is, or as you uncover other missions and visions that you want to be fulfilling, that’s where you can add more later on. It’s a layering process.

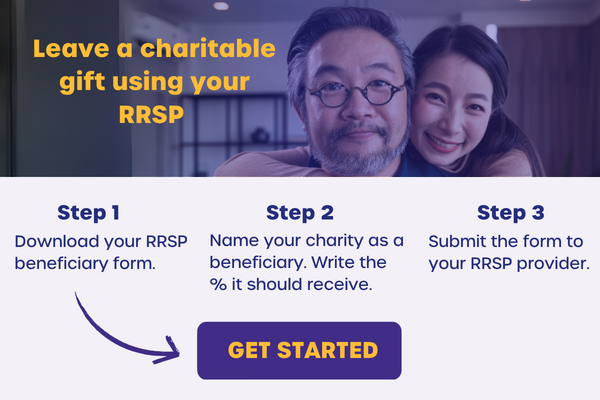

The first step is just to get started. And you can get started with something simple like naming a charity as a beneficiary on your RRSP [Registered Retirement Savings Plan] or RRIF.

Want to maximize your charitable donations and tax savings? Find a financial advisor who can help.

Topic: Financial Tips