Most us know what an RRSP is, right? Maybe you already have one. But are you aware of everything it can do for you?

There are many ways you can use your RRSP, and together with Patrick Smith, a Wealth Advisor at Scotia Wealth Management, we’re offering some financial guidance to help you make the most of your RRSP and other savings plans.

Here we go…

What is an RRSP and why should I have one?

Did you know that RRSPs were created in 1957 so people without workplace pensions could save for retirement? Today, only 38% of workers in Canada are covered by a workplace pension plan. This means the majority of us are on our own when it comes to securing our financial futures.

That’s where an RRSP comes in. A Registered Retirement Savings Plan is an account registered with the Canadian government that helps you save for retirement, while saving on taxes.

“The main reason people use an RRSP is to build a nest egg for retirement,” explains Patrick. “But there are other ways people can use their RRSPs to maximize and optimize their finances.” For example, you can use your retirement fund to make large purchases, or take time off. More on that later.

How do RRSPs and RRIFs work?

Contributing to your RRSP

So how do you use an RRSP to save for retirement? You make contributions to your plan on a regular basis. Each year, you have a limit of how much you can contribute to your fund. Any unused amount will carry over and be added to your limit for future years. The 2024 RRSP contribution limit is 18% of your previous year’s earned income, up to a maximum of $31,560.

How can I make the most of my RRSP?

What makes an RRSP so appealing is that you can use it to save on taxes. The contributions you make can be deducted from the income you declare on your tax return. Chances are, this will lower the amount of taxes you’d have to pay.

This is the government’s way of rewarding you for saving – you don’t pay taxes on the money you pay into an RRSP, instead, you’ll be taxed whenever you take the money out. So the key is to contribute to your RRSP during your higher-earning years when you have a higher taxable income and could use the deduction.

“Let’s say you’re 33 years old and your earned income is $105,000. If you contribute $10,000 to your RRSP (assuming you have the contribution and deduction room), you’d knock yourself into the lower marginal tax bracket.”

“You should think of an RRSP as a long-term investment account,” says Patrick. “When you look at the arc of your life, try to identify which years might be higher- or lower-earning years, and try to reduce and defer taxes accordingly.”

When does an RRSP turn into a RRIF?

Sorry to say, but you can’t keep your RRSP forever! RRSPs mature when you turn 71. At the end of your 71st year, your RRSP will automatically turn into a Registered Retirement Income Fund. (Note that you could also use the proceeds to purchase annuity.)

While RRSPs help you save for retirement, RRIFs pay those savings back to you. Put another way, RRIFs give you an income during your retirement. Be aware that you’ll have to withdraw a minimum amount from your RRIF each year, which increases as you age and will be taxed as income.

Is there such a thing as over-saving in my RRSP?

“A lot of our clients in their early 70s are surprised to see what they’ve accumulated in their RRSPs, even if they’ve just contributed a little bit here and there over the years,” Patrick says. “And they’re surprised at how much tax they have to pay on it.”

The trick is to plan ahead so you don’t get stuck paying hefty taxes on your required RRIF withdrawals. It’s important to get financial advice so you have an idea of how much money you should be putting away, and where you should be putting it.

“Anything remaining in a person’s RRSP or RRIF account when they pass away will appear on their last tax return, which can lead to a fairly substantial tax liability. But, a charitable donation tax credit will often just about offset the tax payable, which is good for the person’s estate, and for the charity.”

Can I withdraw from my RRSP anytime?

You might want to use the money you’ve saved in your RRSP long before you turn 71. In most scenarios, there will likely be a withholding tax if you withdraw from your RRSP early.

Withholding taxes can be substantial. When you withdraw funds from your RRSP early, you’ll pay 10-30% of your withdrawal to this withholding tax. Also, the funds withdrawn are added as income on your tax return. Now, the withholding tax might cover any income taxes owing…but it might not. Typically, it’s best not to move money in and out of these accounts regularly.

But there are some creative ways you can use your RRSP. Let’s show you how.

Financial advice from a pro: Patrick’s 5 surprising ways you can use your RRSP

You don’t always have to wait for retirement to use the savings in your RRSP. Here are some of Patrick’s tips for using RRSPs to save for some of life’s biggest milestones.

1. Taking a break from work

Can’t wait until retirement to take your dream vacation? An RRSP can help you save up for time off.

If you withdraw from your RRSP to support a year off for example, the withholding taxes will likely cover any taxes owing. The taxes withheld on the withdrawal will act as a credit against any taxes that are actually payable when they are calculated at the time of filing your return. In fact, the RRSP income will probably attract a very low tax rate if you have no other income to declare that year. You could potentially recover some of the withholding taxes as a refund.

2. Finance parental leave with income splitting

Let’s say your partner has a spousal RRSP and they are planning time off for parental leave. You, the higher-earner, can make RRSP contributions in advance of that parental leave. When it comes time to take the leave, your spouse can withdraw from that spousal RRSP if need be.

Just as in the previous example, the withholding taxes will apply. But because the spouse on parental leave likely has little or no income to declare, the withholding tax may actually cancel out any income taxes they owe that year, perhaps even lead to a refund!

Just make sure to plan ahead, since funds in a spousal RRSP need to stay in the account for 3 years before they’re withdrawn. If they are withdrawn before this time then the income from the withdrawal is attributed back to the contributing spouse.

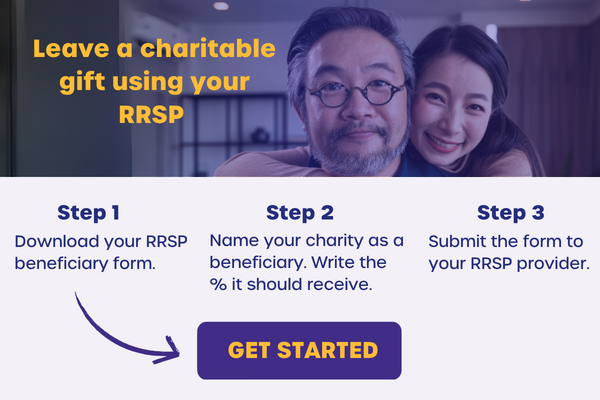

3. Donate to charity!

No surprise here, this is our favourite way to use an RRSP. You can make a shockingly big donation to your charity by naming them as a beneficiary of your RRSP. You won’t be giving up any of the savings you need in your lifetime, whatever is left-over goes to family and causes close to your heart. As a bonus, the donation tax receipt will close to cancel-out the taxes your inheritors would have had to pay on this asset.

“Donating through an RRSP is a great way to make a sizable donation to a charity you care about,” says Patrick. “Anything remaining in a person’s RRSP or RRIF account when they pass away will appear on their last tax return, which can lead to a fairly substantial tax liability. But, a charitable donation tax credit will often just about offset the tax payable, which is good for the person’s estate, and for the charity.”

Here’s a quick and easy way to name a charity as a beneficiary of your RRSP.

4. Buy a home

RRSPs can also help you buy that first home! Through the Canada’s Home Buyer’s Plan, you can withdraw up to $35,000 from your RRSP to help with the down payment on your first home…without penalty.

There’s only one catch – you’ll have to pay the money back into your RRSP within 15 years. Otherwise, the withdrawn amount would become taxable.

5. Finance your education, or your spouse’s

Similar to the Home Buyer’s Plan, with Canada’s Lifelong Learning Plan you can withdraw up to $20,000 ($10,000 per calendar year), tax-free, to pay tuition fees for you or your spouse. This money also needs to be paid back into your RRSP over a period of time.

There are many savvy ways to use your RRSP before retirement, and there are pros and cons of each. Make sure to get the right financial advice, or you could be stuck paying unexpected taxes and fees.

Where can I get an RRSP?

Now that you’ve got dreams of vacations, parenthood, retirement and do-gooding in mind, how can you start saving?

You can set up an RRSP directly through your bank, credit union, trust or insurance company.

Many workplaces have RRSP plans set up for their employees, and offer to deduct contributions directly from your paycheque. Some even offer to pitch in, and match your RRSP contribution! If so, you’ve struck gold!

TFSAs vs RRSPs – how do they differ and what are the benefits of each?

A tax-free savings account is another great way to save for retirement, or for shorter-term goals and purchases.

The main differences between RRSPs and TFSAs are:

- Contributions to your TFSA aren’t tax-deductible. In other words, the money put into your TFSA are after-tax dollars.

- Withdrawals from your TFSA aren’t charged a withholding tax, and you don’t include them as added income on your tax return. You can take money out stress-free at any time.

Basically, with an RRSP you save first and pay taxes later. With a TFSA you pay taxes upfront.

Like an RRSP, a TFSA has yearly contribution limits. “You don’t want to use it like a chequing account and continuously make deposits and withdrawals,” warns Patrick, “since contribution room is not replenished until the calendar year following a withdrawal.”

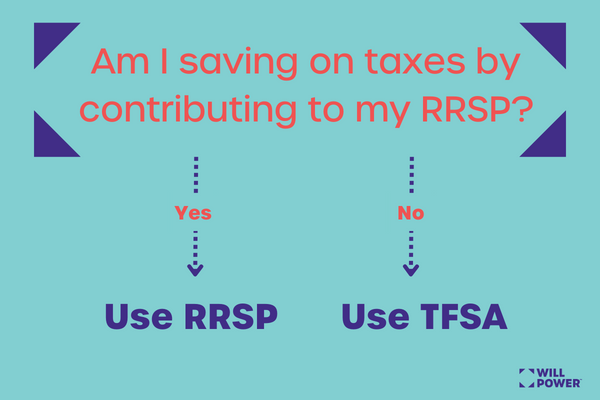

So, when should you use an RRSP or TFSA?

“RRSPs are great if you have little-to-no pension and are looking to build long-term savings for retirement,” says Patrick. “They’re also very effective to use in your peak income-earning years to knock yourself out of a higher tax bracket.”

Let’s say you’re 33 years old and your earned income is $105,000. If you contribute $10,000 to your RRSP (assuming you have the contribution and deduction room), you’d knock yourself into the lower marginal tax bracket. Any additional savings above that $10,000 could go into a TFSA so you have more flexibility with withdrawals in the future.

Now, say you’re in your mid-50s, more advanced in your career, and have built a substantial RRSP. It might be a good idea to start putting any savings into a TFSA. You’ll end up with less of a tax liability in your RRIF during retirement, as well as a flexible source of funds from your TFSA.

According to Patrick, “If you’re not getting much benefit from an RRSP contribution in terms of tax savings, then a TFSA makes more sense. Generally, people making over $125,000 are facing marginal rates of 40% or more in BC and can save the most on taxes with their RRSPs.”

Who gets my RRSP when I pass away?

When you pass away, any unused funds in your RRSP can incur some pretty hefty taxes, which will have to be paid from the inheritance you’ve left behind. But, you can arrange to “rollover” your plan to a spouse (or if you have a financially dependent child or grandchild) to delay those taxes.

Another great way to offset the taxes is by donating to a charity you care about. If you name a charity as a beneficiary of your RRSP, your estate will receive a charitable donation tax receipt that will usually cover the income taxes owed on your RRSP when you die.

Either way, it’s important to plan ahead and designate beneficiaries when you take out an RRSP. You can find the most common RRSP beneficiary forms here.

Financial advice from a pro: Patrick’s top tips to save for your RRSP

1. Pay yourself first

“It’s important to build a habit of saving and stick with it,” says Patrick. “Ideally, you want to save about 10-20% of your income to build a nest egg for retirement.”

2. Max out your match

If you have an employer who offers an RRSP match program, take full advantage of it. When you make a contribution to your plan directly from your paycheque, your employer may add up to an equal amount – it’s free money!

“The return on investment before taxes for RRSP match programs could be 100%,” says Patrick. “You’re not going to find a much better ROI. To the extent people can make use of these opportunities, they absolutely should.”

3. Make a plan

“There’s no rule of thumb for the amount people should contribute to their RRSP, but what I would emphasize is the importance of financial planning and having a written strategy,” says Patrick. “Planning for retirement may seem daunting, but by finding the right balance and options for saving, together we can make sure you reach your life goals.”

Get a head start on RRSP planning by booking a consultation with one of our financial advisors!

Topic: Financial Tips