Philanthropy can be unfair. There is a power imbalance that has left many charities – and the communities that rely on them – behind.

The term “philanthropist” is often synonymous with the wealthy elite; people who can afford to give generously to the causes they care about. When giving power is concentrated among such a small group of individuals, it is only natural that some charities will receive an abundance while others don’t.

An interesting trend has emerged in the past three years though. Canadians from all walks of life and financial standings have discovered that they too can give generously by donating through their Wills. And a greater number of them are doing it, opening up the possibility for a more even distribution of donations.

Why should you care about donating to charity in the first place?

When you think of all the services your community benefits from, it might surprise you to know that many would not exist without charities.

Institutions like hospitals and schools rely on government funding for their operations, but even they need donor funding to support special initiatives like research and student support.

Key issues like environmental conservation, access to affordable housing, and the fight for justice and equity are often tasked to charities. Support for the elderly, people living with a disability, and newcomers to Canada is often provided by charities too. Not to mention arts, culture, and recreational programs. Donations directly influence their ability to serve Canadians and protect the values we all hold dear.

The problem with the current giving model

Canadians are known to be generous: many donate their time, money or both to causes they care about. In 2021, tax filers reported giving $11.8 billion to charitable organizations, with the median donation being $360.

It’s clear that Canadians are eager to contribute when they have the means. The reality is that the majority of charitable giving is actually done by a small percentage of the population.

Making large donations was historically something that only the wealthy were able to do. With ample disposable income, they’ve been encouraged to share their resources by making generous contributions.

The challenge with this model is that a small group of people hold the power to decide which charities receive the most donations. This fundamentally unequal process means some causes are left out of the giving pool.

Indigenous organizations, for example, are chronically underfunded. “Just seeing the amount of philanthropic dollars that are distributed across the country, and where those dollars end up going, you would see that this is very much the case” says Emily Cabrera, Lead, Partnership Development at First Peoples’ Cultural Foundation, an Indigenous-led organization funding Indigenous languages, arts and cultural heritage in BC.

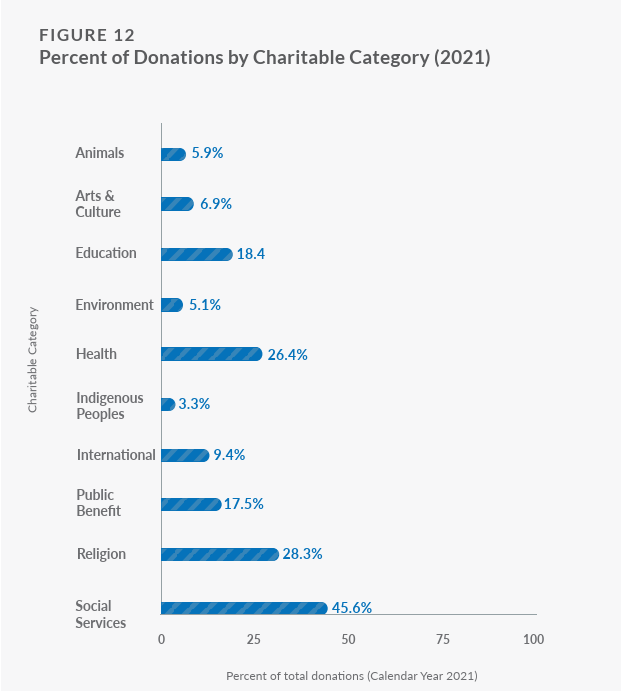

In 2021, only 3.% of all donations on the giving platform CanadaHelps went to charities that contribute to Indigenous communities.

Source: CanadaHelps. The Giving Report 2022.

“That’s less than 3% of donations for Indigenous-led solutions on climate change, health and wellness, youth initiatives, and the braided knowledge of Indigenous arts, language, and cultural heritage.” says Cabrera. “This is work that can benefit everyone, across all communities.”

Bringing balance to philanthropy

There are movements brewing around the world to democratize philanthropy so that a bigger group of people, from a wider range of socioeconomic, racial and cultural backgrounds, decide which charities are funded in their communities.

One big shift taking place in Canada is that people are more savvy about the ways they donate. They are strategically planning their giving so they can contribute more generously.

For example, more and more people are choosing to donate to charity in their Will. Why? Because even as little as 1% of their estate can make a big contribution to causes they care about. In fact, the average charitable donation in a Will is estimated to be around $35,000.

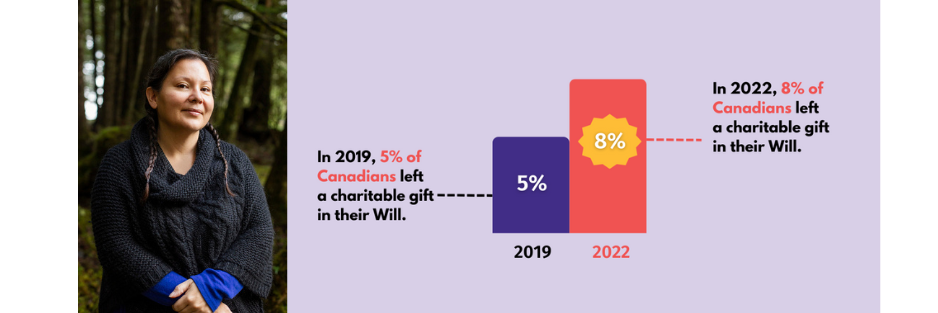

This trend has swelled in recent years. According to a poll conducted by Environics Research, there was a jump from 5% of Canadians reporting a charitable gift in their Will in 2019, to 8% in 2022. That’s 1.2 million Canadians that chose to leave a legacy gift in just three years.

Source: Will Power/Environics Research. Legacy Giving in Canada: A 2022 Update.

In the face of growing social challenges and environmental crises, people are more motivated than ever to make a difference. And with rising inflation and cost of living threatening their financial freedom, it makes sense that Canadians are finding ways to give back that don’t use the resources they need now.

“Already we’ve had some deeply meaningful legacy gifts confirmed” says Cabrera, “a beneficiary of our funding has left a portion of their estate to the organization, and others are contributing through gifts of land. For First People’s Cultural Foundation, this means even more resources to safeguard the transfer of Indigenous knowledge through programs in the arts, language, and cultural heritage.”

How to make a generous difference with your estate

Being more strategic with your giving requires you to think about mobilizing your resources in new and creative ways.

Donating in your Will might be an unfamiliar concept. When you look into it though, you’ll discover you can make a big contribution, without using any of the money you need now…and there are tax advantages too!

How does it all work? Here are some quick answers to the most commonly asked questions:

1) Will I be taking away from the inheritance of my family? Not really. There’s room in your Will to support both the causes you care about and your loved ones. Even 1% of your estate to charity can be a significant donation, and you still leave the majority for family.

2) What if I don’t have the money? You might be surprised. Think of your estate (your home, your savings, etc.) now or in the future – let’s say that equals $500k. Leaving 5% to charity would be a $25k gift, and you still leave $475k as an inheritance for your family.

You can see what kind of contribution you can make using the Will Power Legacy Calculator.

3) Will this be complicated? It doesn’t have to be. It can be as simple as adding your chosen charity alongside the other beneficiaries in your Will. Here’s some advice from a lawyer on steps you should take to write or update your Will and include a charity.

Or, if you have an RRSP you can simply add a charity as one of your beneficiaries. It takes only a few minutes!

4) Are there financial benefits to giving this way? Yes! Your estate is likely to receive a hefty tax bill. When you leave a charitable gift in your Will your estate will receive a tax donation receipt that can help reduce those taxes.

Where to get financial advice about legacy giving

It always helps to speak to a financial advisor before writing or updating your Will, so you know you’re making the best plan for your estate. If you’re looking for financial advice to plan your legacy gift, you can find a list of financial advisors in your area who have partnered with the Will Power campaign – many who offer free consultations.

We have more power than we know. Collectively, we can make small commitments that can lead to great contributions for the causes we value most. With ethical, thoughtful and strategic estate planning, we can democratize philanthropy to fill the gaps in our communities, and create a more equal society for all.

If you have a charity in mind – or even if you don’t – you can explore charities to donate to in your Will and see how they would use your future gift.

Topic: Why Leave a Gift