You probably know about people like John Labatt (the man behind the largest brewery in Canada), H.J. Heinz II (the one and only ketchup king), and Andrew Carnagie (the 19th century industrialist). Not only were they all savvy businessmen, they donated huge amounts of money at the end of their lives. Establishing research centers, funding healthcare and the arts, their endowments continue to make profound contributions decades later.

Generosity is a powerful force for good, but when we think about philanthropy, it’s easy to think of the ultra-rich or those big name celebrities. But did you know regular Canadians are making big moves in philanthropy too? They are doing it using the power of their Will.

Take Katrina Florendo, who in the midst of financial struggles, completed her degree at the University of Toronto thanks to bursaries established by donors. Looking for a meaningful way to give back, she decided to designate the University of Toronto as one of the beneficiaries of a life insurance policy (more on this later). Her donation will fund a bursary for students in the Faculty of Arts and Science because, in her words: “I want to make sure every dollar invested in me will be paid forward exponentially.”

These stories all have a common thread: a desire to leave behind something that outlasts them and continues to do good. Imagine how leaving a donation in your Will could create lasting positive change and support the causes that mean the most to you?

Why more Canadians are choosing to leave donations to a charity in their Will.

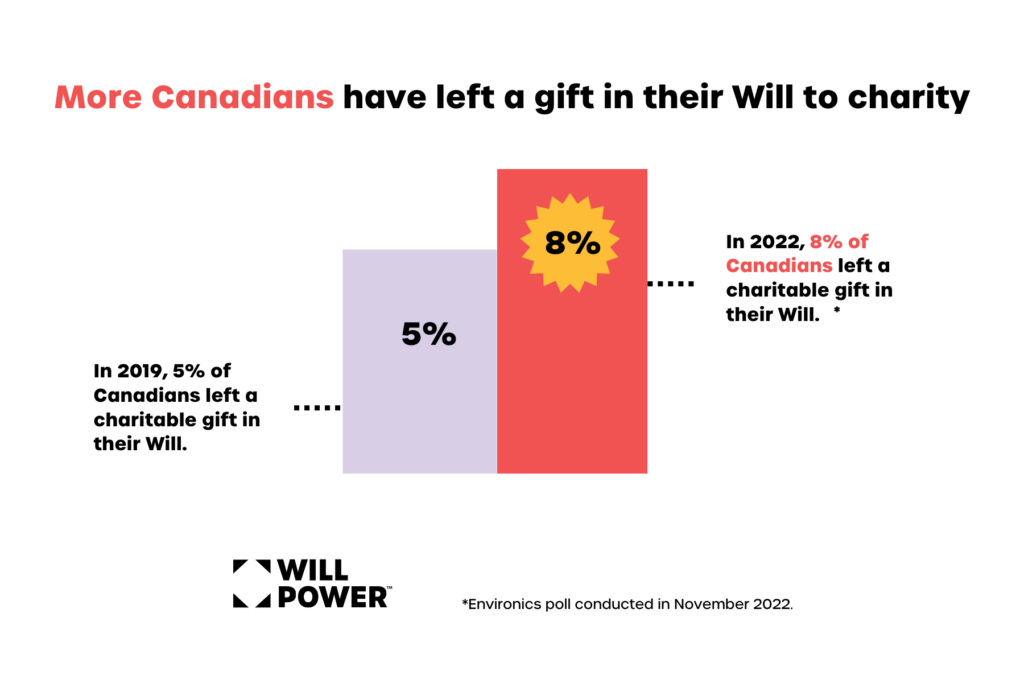

In 2020, 5% of Canadians left a donation to charity in their Will. In 2022, that number rose to 8%. In just three years, 1.2 million more Canadians decided to leave a legacy donation. As we observe the trends, we know that an extra 22% of Canadians are now planning to add a charitable donation in their Will.

Why the surge? It’s a combination of both concern over global issues and difficult economic times. The cost of living may have increased dramatically, leaving fewer folks with money to donate to charity, but the desire to make a difference has never been greater.

People are getting smarter about their finances. So it’s no wonder they are realizing that a donation in their Will is a really smart way to make a mark in this world.

Why donate to a charity in your Will?

There are a few reasons why it’s a really practical decision to give in this way:

- You can meet daily needs while making a difference: First things first, you need to take care of your day-to-day. Like many of us, you contribute to your cause when and where you can. A charitable gift in your Will supplements your giving goals, it allows you to give so much more without taking away from your daily needs.

- You can donate a larger amount: Donating $20,000 now might seem a bit out of this world, but what if we told you that even a small percentage of your Will could translate into a gift this size? If you don’t believe us, take a look at our legacy calculator.

- Your good work lives on: If you’ve been an advocate, volunteer or pillar in your community, a gift in your Will makes sure the good work continues. Not only that, your ongoing influence can rally your family, and motivate future generations to become advocates too!

- You’re making a savvy financial decision: After you pass, all your assets will be realized and counted as income, and your family will be left to deal with some pretty hefty taxes owed by your estate. This is where that donation will come in handy. It will trigger a charitable tax credit that could significantly decrease, and sometimes even eliminate, the taxes altogether.

The biggest myth about donating to charity in a Will.

I’m sure it comes as no surprise – the biggest reason why Canadians don’t leave a charitable donation in their Will is because they plan on leaving everything to their family and loved ones. Believing that a donation takes away from your family’s inheritance is a BIG misconception.

Let’s have some fun for a moment. Imagine taking your Lotto Max ticket to the convenience store and you hear the jingle. You’ve won! Not only that, you’ve won big: 1 million dollars. Suddenly you’re thinking about all the boxes you’d check off:

✅ Get that boat you’ve always dreamed of.

✅ Finally take your kids to Italy.

✅ Help your family members the way you want to.

✅ Donate to that cause you’ve always loved.

Just imagining the ways you could make a difference around you fills you with joy.

Alright, let’s come back to earth again. Guess what? You don’t need to win the lottery to experience the joy of helping others in big ways. And though we can’t help you make it to Italy, we’re here to tell you that it’s actually possible to help your family and the charities you care about.

The average Canadian household net worth is around $980,000, which isn’t too far from 1 million. Of course, this is made up of assets like your house, RRSP, insurance policies and investments. When you think about it, that’s a large sum that can make a huge difference. For many Canadians of average means, choosing to leave a small percentage of their estate to charity translates to anywhere from $20-35K.

This is the power of leaving a donation in your Will to a charity.

How charitable donations in a Will can reduce taxes.

How does the Canadian government encourage us to donate to charities? By offering us some of the best tax incentives in the world.

Here’s the truth: that last tax bill is likely to be your biggest one of all. After everything is sold – your real estate, investments, leftover RRSPs, etc. – your estate will have a lot of income to declare on its final tax form. But if you plan ahead there are some clever ways to avoid the Canada Revenue Agency and make sure your money goes to the people and causes that mean more to you. Here are three tricks you may not know about:

- Donate securities in-kind: If you have publicly traded securities that have appreciated in value, you can donate them to a registered charity and get a double tax benefit. You eliminate both the capital gains on your securities plus get a tax credit for your estate.

Note: Just make sure the stocks are transferred to the charity for them to sell, otherwise the double tax credit won’t apply! - Name a charity as a beneficiary on a life insurance policy: Whether you took out a policy yourself, or were given one through work, adding a charity as one of your beneficiaries will allow you to multiply your donation (and get a bigger tax credit).

- Naming a charity as a beneficiary of your leftover RRSPs/RRIFs: If you have any money left over in your RRSP or RRIF when you die, it will be heavily taxed. But if you name a charity as a beneficiary you can nearly eliminate the taxes that would have to be paid. It’s also the most quick, easy, and flexible way to leave a legacy gift. You can actually find your RRSP/RRIF beneficiary form here and get started right now.

Note: If you live in Quebec, you can only name a charity as a beneficiary of your RRSP through your Will.

If that sounds like a lot and you want a simpler breakdown, Senior Financial Advisor at Assante Wealth, Rich Widdifield, explains what you need to know in 4 minutes.

Please remember, everyone’s financial situation is different. If you’d like to know what works best for you, speak to a financial advisor who knows about estate and charitable planning. We’ve compiled a list of financial advisors (many who offer free consultations) to make the process easier.

Dream big: Choosing a charity to partner with.

This is the fun part, dreaming about the kind of impact you’d like to make. Maybe you’re passionate about the environment, like James, or like Chayanika you believe in the power of music to create social change.

If you’re unsure which charity to include in your Will, we get it. There are a lot of options and that can be overwhelming, which is why most of us struggle to make donations in the first place. Simplifying options is helpful, which is why we’ve helped you find charities by cause and see how they would use a gift in your Will.

Here are some questions to help you get started:

💖 What are the most important causes to me?

🌍 What kind of change would I like to see happen?

🤝 Which charities tackle the causes I believe in?

Start with the charities you’re already involved in, or have helped you or your family in the past. Remember that nothing is set in stone, you can (and probably will) update your Will several times in your life, so you can re-evaluate your charities then.

And if you’re thinking, “I want to see the effect of my donation in my lifetime,” you’ll be happy to know that many charities invite legacy donors into the fold to learn more about the cause and what their donation will do. So speak to your chosen charities and let them know about your intentions, you won’t be held to any commitment but you just might be wowed by your possible impact.

How to write a Will in Canada (and make the most of it).

When’s the right time to write a Will? Ideally, yesterday. But today works, too. We hear a lot of people say “I don’t want to think about death,” and to that we say: this is about life!Writing a Will is about who you are, the life you want to lead, and how you want to be remembered.

We know it can feel intense, but think of writing a Will like getting an oil change or cleaning the gutters. It’s just one of those life maintenance tasks us adults have to do.

Hopefully you’ve realized the time is now, so let’s show you how to write a Will and get the most out of it.

- Think about the most important people in your life. Who do you want to inherit the bulk of your property or assets? It can be family or friends or even an organization. Make sure you have the legal names of all your beneficiaries.

Note: if you have minor children or pets, you’ll need to choose someone who can care for them in your absence. You’ll also need to choose an executor to carry out your Will.

You can download this guide to writing your Will for tips on choosing a guardian, an executor and much much more.

- Think about your legacy and the impact you want to make. What are you passionate about? What causes and organizations speak to you? We suggest you narrow down to no more than three. You can use our charity finder to grab all the details you’ll need to include them in your Will.

- Take stock of what you have. You don’t need to know the numbers down to the detail, but you should have a handle on your assets (real estate, savings, a business or valuables) and debts (mortgages, student loans, lines of credit, etc.).

Once you have a handle on the size of your estate, you can start figuring out what percentage should go to each of your beneficiaries, including your chosen charities. You can use our legacy calculator to help. - Think about who is going to draft your documents? There are many choices when it comes to Will writing these days. But if you’d like advice on how to divide your estate – especially if you have a complicated family or financial situation – and save on taxes, you’ll definitely want to work with a lawyer or notary if you live in Quebec or BC. Otherwise you might explore a reputable online Will platform.

Note: if you are going to write a Will with family and charity in mind, it’s important to work with a professional who’s in the know. We have a list of lawyers and notaries who are experts in estate and charity planning, or bring this guide to Speaking to your Advisor to a professional you already know.

There you go, that’s not that bad. Only 4 steps and you’re done! Don’t forget to pull out your Will every couple of years to see if there are any updates that need to be made

The power of your legacy is in your Will.

At the end of the day, it’s not all about money – it’s about making a difference. While we work hard to do meaningful things with our lives, it’s pretty amazing to consider how that work can continue after we’ve taken that final bow. The show goes on when you include a charity in your Will.

Think of it as your way of saying, “I believe in a future where everyone has a shot, where our planet is cherished, and where kindness triumphs.” You get to be part of something bigger—something that helps shape a better world for generations to come. Who doesn’t want that?

If you want to learn more about the power of your Will, join us for a free webinar hosted by Laurie Fox, Will Power campaign director, and Keith Thomson, financial advisor, educator and consultant specializing in estate and charitable tax planning. You can watch on-demand or join us for a live session.

Topic: Why Leave a Gift