If you’re thinking, “Yikes, writing a Will? That’s a task I’d rather skip,” let’s hit refresh on that mindset. Think of a Will as a time capsule – something that holds precious pieces of your life and passes down values to your family. When you write a Will, you’re doing more than just boring legal work, you’re creating a legacy of your life.

Sure, this can feel daunting, but it’s also exciting. Writing a Will gives you a chance to sit down and think about the full picture of your life, reflecting on what you care about and what you want to achieve in this world.

Are you ready to start? We provide really great Will creation tips – plus ways to make the most out of the experience! Here is everything you need to know about creating a legal Will in Canada, including Will preparation, Will writing, guides for financial advice, and donating to charity in your Will:

Covering the basics: When to write a Will

Before we dive in, let’s cover some of the basics. For instance, when should you write a Will?

Well, if you’re old enough to legally have “an adult beverage” in Canada, you’re old enough to have a Will. Writing a Will is just a part of adulthood, like opening an RRSP or doing your taxes. You don’t need a lot of assets or money in the bank – you can start with what you have and add on as the years bring more into your life.

Why you need to write a Will (and what happens if you don’t)

Why do you need a Will in the first place? Plain and simple, it’s a way to make sure your loved ones are taken care of when you’re not around. It gives direction on who gets what and how things should play out. This is especially important if you have young kids and fur babies.

We’d rather not think about what happens if you don’t have a Will, but it’s a real situation for a lot of people. Worst case scenario is that the courts step in to make decisions and your children, pets and other dependents are left with less than ideal guardians. Your assets could go to people you don’t want to receive them. Or at the very least, an emotional situation is made all the more stressful as your family scrambles for solutions and racks-up legal fees.

Overall a Will gives your family and friends protection, clarity, and peace of mind.

Don’t worry if you haven’t started on yours yet – there’s no time like the present! We’re here to make sure you have everything you need to get started. Our free webinar on How to Write a Will in Canada covers all the basics.

Can you make your own Will or do you need legal support?

For a Will to be legal in Canada you just need to be an adult, be mentally sound, and have your Will signed and witnessed. So you can write your own Will and still have it be legally binding, but should you?

Writing your own Will is a bit like trying to bake macarons without a recipe. Sure, it might work, but it’s easy to miss important details.

It’s completely up to you, but consider this – a Will that doesn’t follow the right legal formalities, or account for all assets and complex situations, could be overturned by the courts. This means your intentions and hopes won’t be honoured, and your estate will end up paying more in legal fees than you would have paid writing your Will with a lawyer in the first place.

The cost associated with writing a Will in Canada

The cost to write a Will depends on where you live and how much help and legal advice you’ll need (i.e. do you need help setting up a trust for children or with tax planning?). You can expect to pay anywhere from $150 to $1500+ for complex estates.

Whatever the cost, we can’t stress enough how important it is to make this investment. A properly drafted, well-written Will saves everyone a lot of stress in the future.

What about online Will services? Are they legal? Who are they designed for?

Using a reputable online Will service is a good option for anyone with a fairly straightforward estate. That could be you if you don’t have any complex family or financial situations and aren’t in need of professional legal advice (i.e. protections for young children, tax planning advice, etc.)

If you’re not sure, and would like to take a deeper dive, you can read our article about what to consider when writing an online Will.

Writing a Will in Canada: How to begin in 5 easy steps

Now that all of those questions are out of the way, let’s talk about how to practically start writing a Will. Making sure that everyone and everything is taken care of can feel overwhelming, so let us help you gather your thoughts and compile all the information you need.

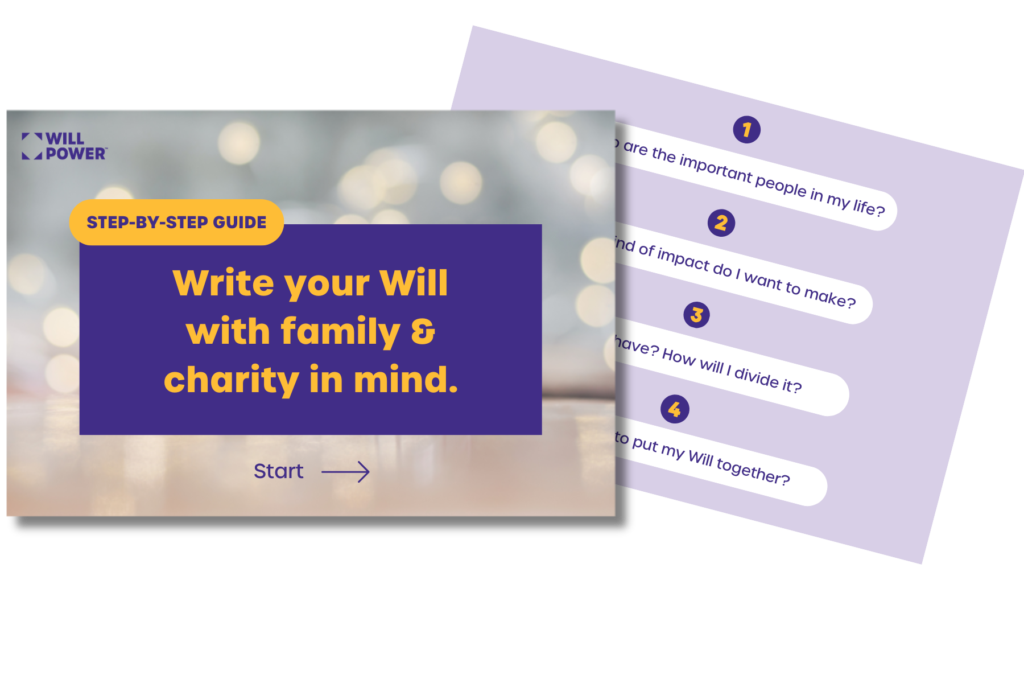

Here are 5 easy steps we recommend when drafting a Will with your family and legacy in mind:

1. Consider the people who matter most to you. Who would you like to inherit your property, assets and all the precious pieces of your life? It could be family, friends, or even an organization. Be sure to have the full legal names of your beneficiaries in order to minimize any sticky misunderstandings. (P.S. It’s good practice to have back-up beneficiaries too.)

If you have young children or pets, decide on a guardian you’d trust to care of them. You’ll also want to choose an executor who will carry out the details of your Will.

Beyond simply naming who gets what, you could also think about writing a letter to accompany your Will. Use it to share the stories, values, and personal connections tied to what you leave behind. This letter can also include personal notes, family wisdom, or specific instructions that go beyond legalities.

2. Think about the legacy you want to leave in this world. What kind of issues are you passionate about? What kind of change would you like to see? You can add a donation in your Will to a cause you care about and make a meaningful impact after you’re gone. Our suggestion is to narrow down the charities you’d like to include in your Will to no more than three. Our charity finder is a great resource to help with that.

3. Get a sense of the size of your estate. Review what you own and owe. You don’t need exact figures but it’s good to have a general idea of your assets (i.e. real estate, savings, businesses, valuables, etc.) and your outstanding debts (i.e. mortgages, student loans, lines of credit, etc.).

4. Decide what percentage of your estate will go to each beneficiary. Once you know the size and numbers you’re working with, you can decide where you want everything to go. Our legacy calculator can be a great help to see how much you might want to leave to family, and how much to charity.

5. Finally: putting it all together in a legal document. Now that you have a rough sense of who you want to include in your Will and what your estate might be, it’s time to get drafting! This is where the experts come in. A trusted lawyer or notary (if you’re in Quebec or BC) will do all the work to create a rock solid Will that reflects your wishes and takes care of all future scenarios.

You can find lawyers and notaries, who are also experts in estate and charitable planning on our website.

Our Guide to Writing Your Will is here to help you take that first step with confidence and clarity. By starting now, you ensure your values and experiences become a legacy that lasts.

What is estate planning? Is this something I need to do?

You may have heard the term “estate planning” and breezed straight by it thinking it’s only for people with a collection of diamonds and fur coats. Right?

But here’s the thing: estate planning is for everyone, not just the wealthy. An estate is simply all the assets (minus debts) you have when you die. Your estate could be big or small, and include your home, bank accounts, savings and investments.

While you don’t need to plan out your future finances, it is a good idea. A well-thought-out estate plan, often done with the help of a professional advisor, can help you make the most out of your money. Among other things, it will help make sure you have enough to support your loved ones in the way that you wish after you’re gone, and avoid unnecessary taxes and other financial pitfalls.

A common myth is ‘Estate Planning is only for the wealthy.’ Estate planning isn’t reserved for some secret club or super wealthy group of individuals. Having an estate plan may be even more crucial for smaller estates where every asset will be important in supporting your loved ones.

~ Landon Hang, National Director, Strategic Initiatives & Business Development at BMO.

Savvy estate moves: Leaving a charitable donation in your Will.

If a Will captures the important things in your life, then this is your chance to really put your money where your heart is. By adding a charitable donation to your Will, your name lives on through both the gift itself and the example you leave to your family. You could instigate real change through new programs, services, and emergency funds.

Not only do you get to make a meaningful contribution to an organization you love, this is a savvy estate move that will save money in the long run. How exactly? Well, when you pass, your estate is likely to receive a substantial tax bill. Making a donation in your Will means your estate will get a charitable tax credit that can be used to lower the amount of taxes owed. Depending on your financial situation, you could significantly reduce or completely eliminate the taxes to be paid, leaving more for the people and causes you love. We’ve explained how charitable tax credits work here:

Think this is about big philanthropists? Think again! Michael Vechikar is an engineer who never thought he could make a big donation in his life. But after hearing about leaving a charitable donation in a Will, he did the math and realized a mere 3% of his Will could translate into a five-figure gift.

Most Canadians are looking at their bank balances and the rising cost of living realizing they can’t give the way they want to right now. Michael proves that a small slice can make a huge difference. For most Canadians, leaving just 1% in a Will to charity could be a $10,000 donation or more! It’s a way to make that big donation without taking away from daily needs.

FAQs: Finalizing your legal Will in Canada.

Here’s what we hear the most when it comes to getting everything signed and sealed:

Q: Does my Will need to be notarized?

A: Your Will doesn’t necessarily need to be notarized, it often depends on where you live. Your Will does generally need to be witnessed though. Just make sure the witnesses aren’t people who will benefit from your will—aka, one of your beneficiaries.

Q: Is there a central registry in Canada?

A: There isn’t one central registry in Canada where your Will can be stored for your executor to find later (though there is one in Quebec if you complete your Will with a notary). So, when you’re all done, make sure you store your Will in a safe place and let your family and executor know exactly where it is.

Q: Who should I tell about my Will?

A: It’s important to let your family and other beneficiaries (i.e. charities) know about your intentions so that everyone knows what to expect. As much as you may love surprises – this isn’t the best time for them! If you’re worried, think about how it could actually turn out to be a beautiful conversation and bring you closer to your loved ones.

Q: How often should I review or revise my Will?

A: We recommend reviewing your Will every 3-5 years. Babies are born, people move away, homes are bought and businesses are sold, so you’ll want to make sure your Will is properly reflected and up-to-date with all your latest beneficiaries and executors. Because who knows when life will throw a curveball?

Pro tip: make a plan to review every February 29th – that way you remember every four years!

Notes about power of attorney documents, health directives and mandates.

Though not technically part of your Will, power of attorney, health directives, and mandates in Quebec are legal documents that should be done in conjunction with your Will. These are important tools that allow you to appoint someone to make decisions on your behalf if you’re unable to do so. To get a grasp on what this all means, here’s a breakdown of each:

1. Power of Attorney.

Power of attorney is a legal document that gives someone the authority to manage your affairs if you are incapacitated. You can have a Power of Attorney for your finances and property, and a Power of Attorney for personal care.

2. Health Directives.

Health directives allow you to outline your wishes around medical care in case you’re unable to express them yourself. You can be crystal clear about:

- Whether you want to receive life-saving treatments (e.g., resuscitation, life support).

- Preferences for specific treatments in situations like terminal illness or permanent unconsciousness.

Health directives can help your loved ones and healthcare providers make decisions that align with your values and preferences if you cannot communicate them directly.

Note: In Quebec, Power of Attorney and Health Directives are called Mandates.

Support your loved ones and make a positive impact.

In the end, a Will isn’t just about dividing belongings; it’s a way of guiding your loved ones and giving them peace of mind as they continue the journey in your absence. Just as a map offers direction when the path is unclear, your Will can be a compass for those you care about, guiding them through an unfamiliar landscape. When it’s all said and done, we promise you’ll feel a sense of pride knowing you’ve left a piece of your heart and a great legacy behind.

Download the guide to writing your Will with family and charity in mind to get started.

Topic: Will Writing Tips